In the rapidly evolving landscape of decentralized finance (DeFi), automation has become a critical component for traders and investors looking to maximize their returns. Enter UniBot, an innovative trading bot designed to simplify the trading process, enhance decision-making, and optimize profitability in the DeFi space. This blog will explore what UniBot is, how it works, its key features, and its potential impact on the future of automated trading.

UniBot is an automated trading bot that operates primarily on decentralized exchanges (DEXs) like Uniswap, leveraging smart contracts to execute trades quickly and efficiently. Designed for both novice and experienced traders, UniBot aims to eliminate the complexities associated with manual trading while providing users with tools to enhance their trading strategies. By automating various aspects of trading, UniBot allows users to focus on strategy rather than execution.

Key Objectives of UniBot

Automation: UniBot automates the trading process, allowing users to execute trades without the need for constant monitoring.

Efficiency: The bot aims to execute trades quickly and at optimal prices, reducing slippage and increasing profitability.

User-Friendly Interface: UniBot focuses on providing an intuitive user experience, making it accessible for users of all skill levels.

Strategy Optimization: The platform offers various tools and features that enable users to develop and optimize their trading strategies.

1. Integration with DEXs

UniBot integrates seamlessly with popular decentralized exchanges like Uniswap, SushiSwap, and others. By connecting to these platforms via their APIs, UniBot can access real-time market data, execute trades, and manage user funds securely.

2. Smart Contracts

At its core, UniBot leverages smart contracts to automate trading processes. These self-executing contracts allow the bot to execute trades based on predefined conditions, ensuring that transactions are carried out efficiently and without human intervention.

3. Trading Strategies

UniBot supports a range of trading strategies, from simple buy-and-hold tactics to more complex algorithms like arbitrage, market making, and liquidity provision. Users can customize these strategies according to their risk tolerance and investment goals.

4. Risk Management

UniBot incorporates various risk management features, such as stop-loss orders and take-profit levels, to help users minimize losses and lock in profits. These tools are essential for maintaining a balanced trading approach in the volatile DeFi market.

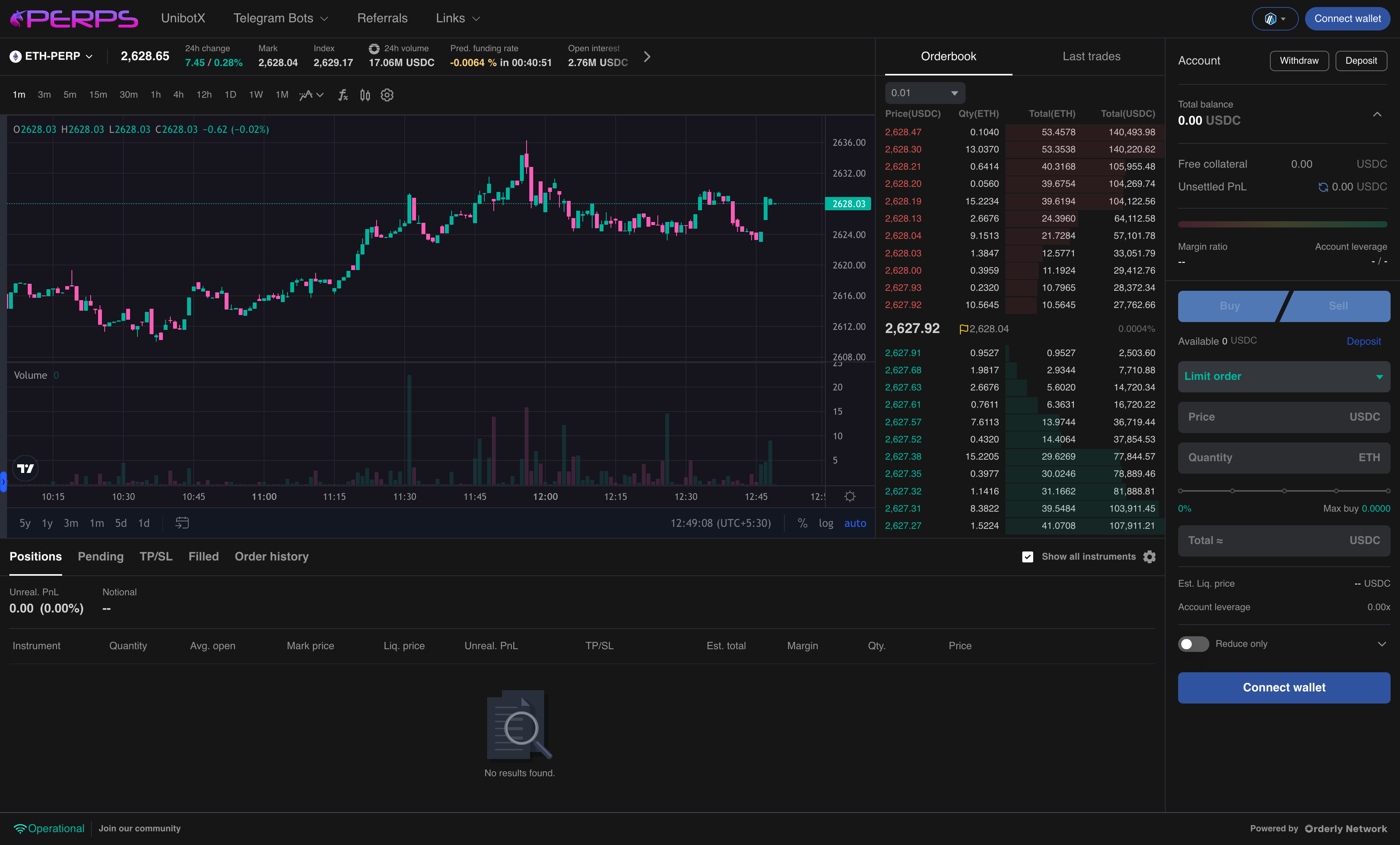

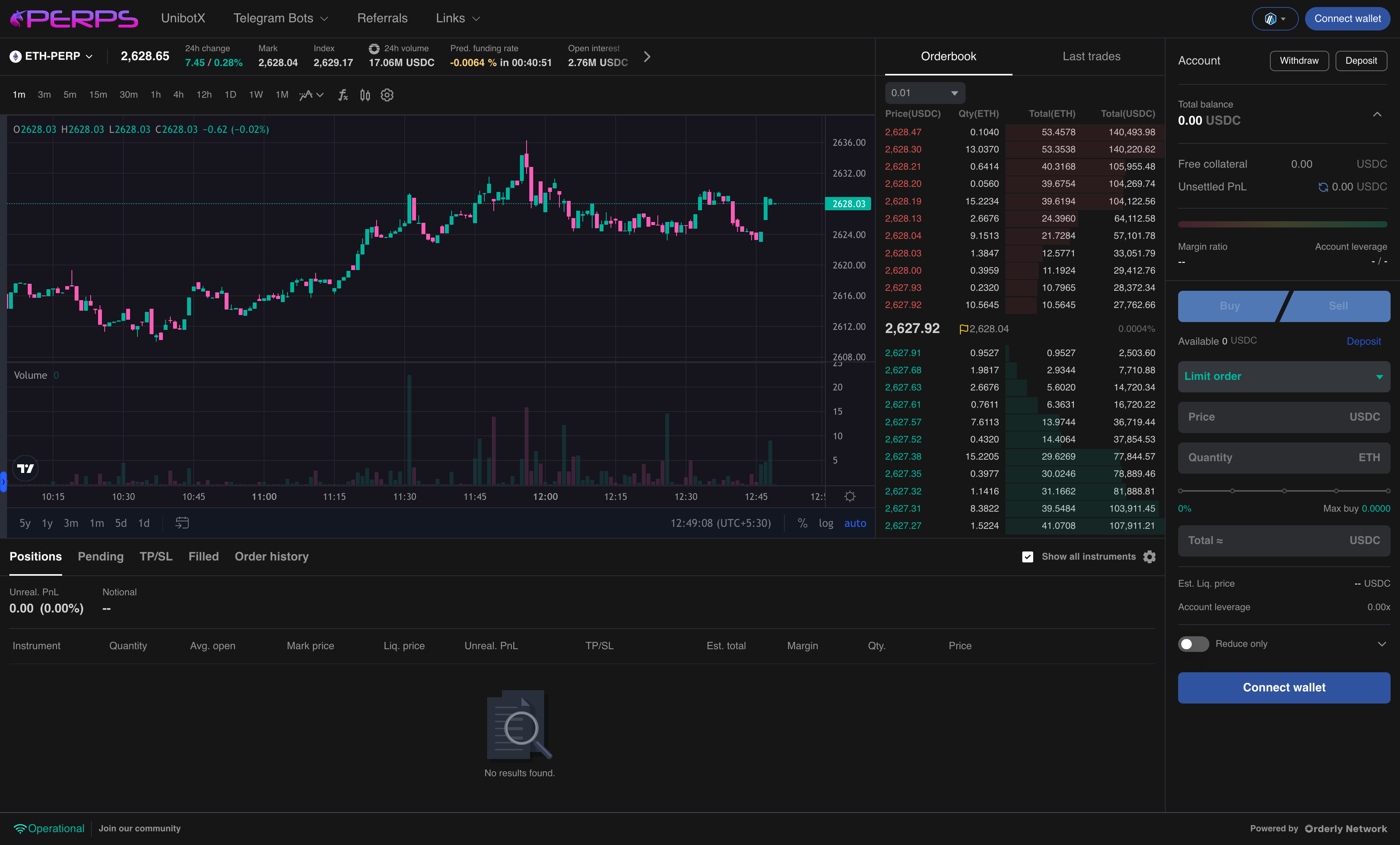

5. User Dashboard

The UniBot user dashboard provides a comprehensive view of trading performance, including profit and loss statistics, trade history, and real-time market data. This interface allows users to monitor their strategies and make informed decisions.

1. Automated Trading

UniBot’s primary feature is its ability to automate trading processes. Users can set specific parameters for their trades, such as entry and exit points, and the bot will execute trades on their behalf, eliminating the need for constant monitoring.

2. Multiple Trading Strategies

UniBot supports various trading strategies, allowing users to choose the approach that best fits their investment style. Whether users prefer high-frequency trading or long-term holding, UniBot has options to accommodate different strategies.

3. Real-Time Analytics

UniBot provides users with real-time analytics and data, enabling them to track market trends and make informed decisions. The platform offers insights into price movements, volume changes, and other market indicators.

4. User-Friendly Interface

Designed with accessibility in mind, UniBot offers an intuitive interface that simplifies the trading process. Users can easily navigate the platform, set up their trading strategies, and monitor performance without technical expertise.

5. Customizable Alerts

UniBot allows users to set up customizable alerts based on specific market conditions. Users can receive notifications for price changes, trade executions, and other important events, ensuring they stay informed without being glued to their screens.

6. Community and Support

UniBot fosters a strong community of users and developers, providing resources, tutorials, and support. This community-driven approach enhances user experience and encourages knowledge sharing among traders.

1. Democratizing Access to Trading

UniBot democratizes access to automated trading by providing tools that are easy to use and accessible to anyone, regardless of their trading experience. This inclusivity encourages more people to participate in DeFi.

2. Enhancing Trading Efficiency

By automating trading processes, UniBot enhances the efficiency of trading in the DeFi space. Faster execution times and reduced slippage help users maximize their returns, making trading more profitable.

3. Supporting Strategy Development

UniBot’s support for multiple trading strategies allows users to experiment and develop their own approaches to trading. This flexibility fosters innovation and growth in the DeFi ecosystem, as users share and refine their strategies.

4. Risk Management

With built-in risk management features, UniBot helps users navigate the volatile nature of the crypto market. By allowing users to set stop-loss and take-profit levels, the bot minimizes potential losses and protects investments.

5. Bridging the Gap Between Traditional and Decentralized Finance

UniBot serves as a bridge between traditional trading practices and the innovative world of decentralized finance. By providing familiar tools and strategies in a decentralized context, UniBot helps ease the transition for traditional investors into the DeFi space.

1. Day Trading

Day traders can benefit from UniBot’s automated trading capabilities. By setting specific parameters for trades, day traders can execute multiple trades throughout the day, taking advantage of short-term price movements.

2. Arbitrage Opportunities

UniBot can identify and execute arbitrage opportunities across different DEXs. By automating the process, users can capitalize on price discrepancies between exchanges quickly and efficiently.

3. Liquidity Provision

Users looking to provide liquidity to DeFi protocols can utilize UniBot to manage their liquidity positions. The bot can automatically execute trades based on market conditions, optimizing returns from liquidity provision.

4. Long-Term Investing

For long-term investors, UniBot can automate the buy-and-hold strategy, allowing users to accumulate assets over time without the need to monitor the market constantly.

5. Portfolio Management

UniBot can assist users in managing their cryptocurrency portfolios by automating rebalancing strategies. Users can set parameters for when to buy or sell assets, ensuring their portfolios remain aligned with their investment goals.

1. Market Volatility

The cryptocurrency market is known for its volatility, which can pose challenges for automated trading strategies. Users must be aware of potential risks and develop strategies that account for sudden price swings.

2. Security Concerns

While UniBot prioritizes security, users must remain vigilant about their own security practices. This includes using secure wallets, enabling two-factor authentication, and being cautious with private keys.

3. Technical Limitations

Automated trading relies on technology, and technical issues can arise. Users should be prepared for potential outages or downtime and have contingency plans in place.

4. Regulatory Landscape

The DeFi space is subject to evolving regulations, and users should stay informed about any legal implications of using automated trading bots in their jurisdictions.

1. Expanding Features and Functionality

UniBot plans to expand its features and functionality, incorporating advanced trading algorithms and machine learning capabilities. These enhancements will enable users to refine their trading strategies and improve performance.

2. Community Engagement

UniBot will continue to foster community engagement by hosting events, webinars, and forums for knowledge sharing. This collaborative approach will enhance the overall user experience and drive innovation.

3. Integrating with More DEXs

To provide users with greater trading opportunities, UniBot aims to integrate with additional decentralized exchanges. This expansion will enhance liquidity options and broaden the range of assets available for trading.

4. Educational Resources

UniBot is committed to providing educational resources for users. This includes tutorials, webinars, and articles to help users understand DeFi, trading strategies, and the use of automated bots.

5. Enhancing Risk Management Tools

As the DeFi landscape evolves, UniBot plans to enhance its risk management tools. This includes more sophisticated stop-loss and take-profit mechanisms, enabling users to better protect their investments.

UniBot represents a significant advancement in the world of automated trading within the DeFi ecosystem. By simplifying the trading process and providing users with powerful tools to enhance their strategies, UniBot is positioned to drive greater adoption of decentralized finance.

As the DeFi space continues to grow and evolve, automated trading solutions like UniBot will play a pivotal role in shaping the future of trading. With its commitment to innovation, user experience, and community engagement, UniBot invites traders and investors to join its mission of transforming the way we approach trading in the decentralized world.

In a landscape characterized by rapid change and innovation, UniBot stands out as a powerful tool for navigating the complexities of the cryptocurrency market. Whether you are an experienced trader or new to the space, UniBot offers the tools and support needed to succeed in the exciting world of decentralized finance. As the platform continues to evolve, it promises to unlock new possibilities for users and contribute to the ongoing transformation of the financial landscape.

Free AI Website Builder